What is the IMF Dollar Exchange Rate Forecast? How to Calculate? Applied Example

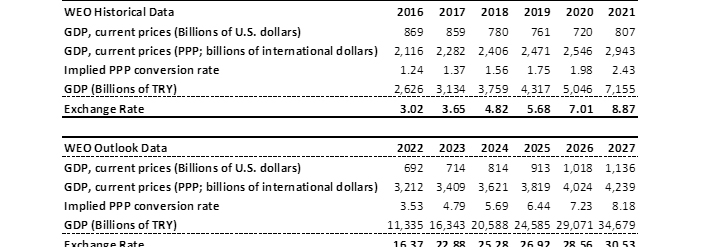

In the World Economic Outlook Report, the IMF published current economic data for 2022, 2023, 2024, 2025, 2026 and 2027 and its forecasts for the coming years.

In this article , we will calculate the IMF’s USD/TRY exchange rate forecast for 2022, 2023, 2024, 2025, 2026 and 2027, based on the purchasing power parity (PPP) estimates in the IMF World Economic Outlook Report .

How far does the dollar go?

Should we buy dollars? How far does the dollar go? What happens to the dollar? What will be the dollar exchange rate at the end of 2022? What will happen to the dollar in 2023? If you want to give a short and clear answer to those who ask, you can boldly state the forecast figures of the IMF World Economic Outlook Report, which has objective and detailed data. After all, the huge IMF forecast

IMF global economy forecasts are invaluable data for you to compare with the latest dollar comment headlines or optimistic expert comments on the internet.

Why is the IMF Dollar Rate Forecast Important?

In our analyzes that involve predictions about future periods, such as investment plans, budget projections, cash flow projections in companies we work with, or especially when evaluating our contracts in foreign partnerships, we have to use objective dollar exchange rate estimates for future periods. In this respect, we benefit from the IMF “World Economic Outlook Report” estimates, which are created with very valuable and detailed economic data.

Let’s examine the data we will use and the links we can access when calculating the dollar exchange rate forecast;

What is the World Economic Outlook Report?

World Economic Outlook Report ; It is a report prepared by IMF economists that provides a detailed analysis of global economic developments in the near and medium term, taking into account the problems affecting economies, and is generally published twice a year, in April and October. Here you can access current and forecast data on many economic data.

Click to access the April 2022 World Economic Outlook Report;

https://www.imf.org/-/media/Files/Publications/WEO/2022/April/English/text.ashx

What data should I use to calculate dollar exchange rate estimates?

There are three data we can obtain from the World Economic Outlook Report to calculate the dollar exchange rate estimate: Purchasing power parity (PPP), Gross domestic product (GDP) (US Dollar, Billion), Gross domestic product (GDP) (Purchasing Parity)

What is Purchasing Power Parity (PPP) (Implied PPP Conversion Rate (National Currency Per International Dollar))?

Purchasing power parity (PPP) is a parity that relates changes in the nominal exchange rate between two countries’ currencies to changes in the countries’ price levels. It can be thought of as a common currency that reflects and compares the absolute purchasing power between countries. PPP is a good alternative for comparison, especially when official exchange rates are artificially manipulated and deviate significantly from their long-term equilibrium.

Click to access IMF Purchasing Power Parity (PPP) data;

https://www.imf.org/external/datamapper/PPPEX@WEO/OEMDC/ADVEC/WEOWORLD

What is Gross Domestic Product (GDP) (US Dollars) (GDP, Current Prices (Billions Of US Dollars)) ?

Gross domestic product (GDP) is an economic measure that represents the total market value of all final products produced over a period of time, usually a year.

Click here to access IMF gross domestic product data in US Dollars;

https://www.imf.org/external/datamapper/NGDPD@WEO/OEMDC/ADVEC/WEOWORLD

What is Gross Domestic Product (GDP, Current Prices (Purchasing Power Parity; Billions Of International Dollars)) ?

GDP represents the total value in PPP terms of final goods and services produced in a country over a given period of time at current prices (purchasing power parity).

Click here to access IMF Gross Domestic Product data in Purchasing Parity (PPP) terms;

https://www.imf.org/external/datamapper/PPPGDP@WEO/OEMDC/ADVEC/WEOWORLD

Now let’s calculate the IMF exchange rate forecasts

IMF Exchange Rate forecast calculation steps;

- The 3 relevant data are downloaded from the IMF database.

- The gross domestic product in Turkish Lira is obtained by multiplying the relevant year’s gross domestic product in purchasing parity and the relevant year’s purchasing parity .

- The gross domestic product (GDP) in Turkish Lira that we obtained is divided by the gross domestic product (GDP) in US Dollars of the relevant year that we obtained from the database, and the IMF exchange rate forecast for the relevant year is shared with you.

You can use the following formulas when using data;

GDP (TL) = GDP (PPP)

USD/TRY=GDP (TL)/GDP (US Dollar)

GDP (TRY) = GDP, current prices (Purchasing power parity; billions of international dollars)

Exchange Rate=GDP (TRY) / GDP, current prices (Billions of US dollars)

APPLICATION;

Since the data is available in English on the IMF website, the examples are taken as written on the website, which will help you find the data more easily.

2022 Average USD/TRY Parity Calculation;

2022 GDP, current prices (Purchasing power parity; billions of international dollars): 692.38

2022 Implied PPP conversion rate (National currency per international dollar): 3.53

2022 GDP (TRY): 11,335

2022 GDP, current prices (Billions of US dollars): 3.212

2022 USD/TRY Exchange Rate: 16.37

According to the IMF World Economic Outlook Report (WEO), Average US Dollar Exchange Rate (USD/TRY) Estimates are as follows by Years;

16.37 for 2022, 22.88 for 2023, 25.28 for 2024, 26.92 for 2025, 28.56 for 2026, 30.53 for 2027.

You can use this data until a new economic report is published in October.

I hope the data will help you in your work.